API Banking

Open banking enables third parties to develop new products and services through use of APIs. By working together and taking advantage of APIs, banks and fintech firms can leverage their complementary strengths, enhancing the customer experience much more than either entity could do on its own. PSD2 is expected to accelerate open banking because it requires banks to open up data and transactions to certain new payment market entrants.

-

Yapily

Yapily is how companies connect to banks via API

-

tink

The rails and brains of open banking

-

aplonAPI

-

SynapseFI

SynapseFI is a banking platform that enables companies to provide finance products to their customers

-

Rapyd

The fastest way to offer local payment methods and fintech services anywhere you do business.

-

Particeep

Particeep is a finTech that provides financial institutions a technology to market online their products

-

Open Bank Project

Bank as a platform. Transparency as an asset.

-

TrueLayer

Simple Bank APIs

-

Starling Bank

A smarter bank for an ever-changing world.

-

Fabrick

API componibili, robuste e pronte all'uso per costruire le tue applicazioni e servizi.

-

Monzo

The bank of the future

-

Fidor

Fidor Bank is a web-based bank that offers online banking services to individuals and businesses

-

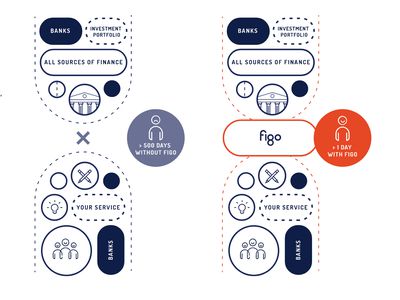

Figo

With only one single API you can easily implement banking functions into your service.

-

Plaid

The API for banking data.

-

Kontomatik

It is an API that lets financial companies access the banking data of their users

-

Yodlee

Leading data aggregation and data analytics platform powering dynamic, cloud-based innovation

-

Salt Edge

Leading global financial data aggregation provider.

-

Quovo

Financial account aggregation, bank authentication, and data insights.