- 14/11/2023

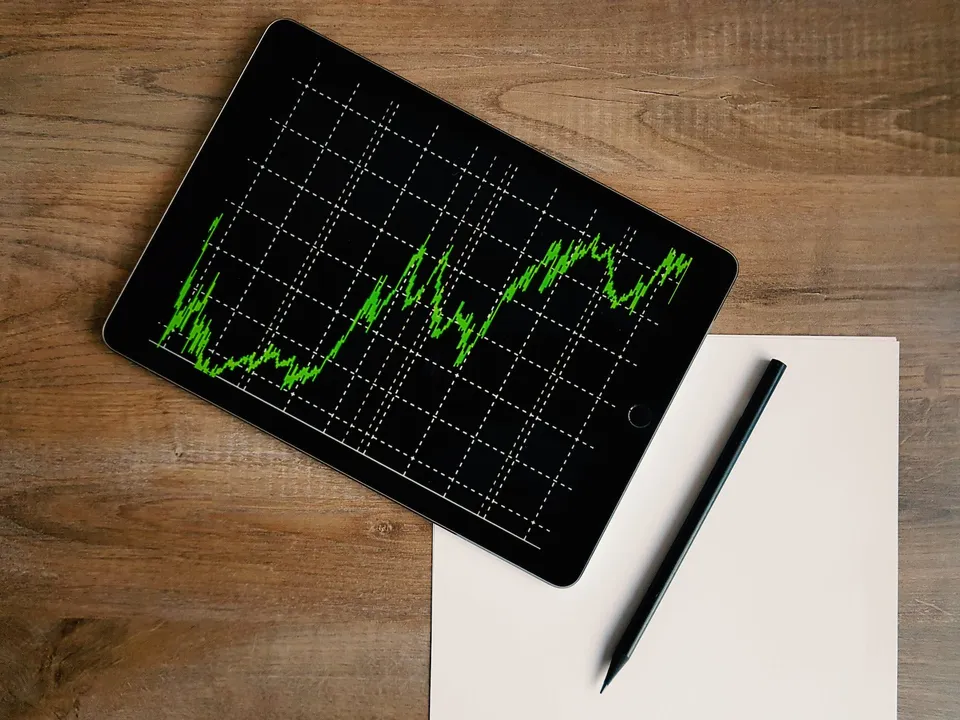

In the fast-paced world of trading, where stocks, commodities, and foreign exchange currencies are bought and sold in pursuit of profit, traders face a whirlwind of challenges beyond crunching numbers and devising strategies. These traders, whether individuals or institutions, must grapple with the intricate psychology that lies beneath every trade. Beyond mastering charts and technical indicators, understanding the psychology of trading is the linchpin to long-term success.

This article will delve into the intriguing world of trading psychology, exploring the emotional rollercoaster traders ride and offering strategies to keep those emotions in check.

The Emotional Challenges of Trading

As traders grapple with the emotional challenges of the market, they often seek reliable strategies to maintain composure and make informed decisions, such as the Ichimoku Strategia highlighted in resources like the one offered by Skilling.

Here are some key factors that traders must learn to navigate:

Navigating Highs and Lows

Trading is a journey laden with emotional highs and lows. Winning streaks are exhilarating, infusing traders with a sense of triumph, while the agony of defeat creeps in when investments sour. These emotional surges can be intoxicating, but they also hold the power to spur impulsive decisions that can dent one's portfolio.

The Psychological Impact of Losses

The impact of financial losses can be profound, stirring up the fear of missing out (FOMO) and the fear of losing more (FOLM). These emotions often lead to irrational decision-making. Traders must recognize how these emotions can sway their judgment, potentially perpetuating further losses.

Stress, Fear, and Greed in Trading

Three dominant emotions—stress, fear, and greed—loom large in the trading world. Stress can grip traders amidst market volatility and the relentless pressure to make quick decisions. Fear can paralyze, causing hesitation or excessive caution.

Meanwhile, the siren call of greed can entice traders into taking uncalculated risks. Identifying and managing these emotions is pivotal for trading success.

Strategies for Managing Emotions in Trading

To conquer the turbulent trading seas, traders must equip themselves with a sturdy anchor—practical strategies for mastering their emotions and steering a steady course toward success.

Mastering Stress

Stress management techniques form the cornerstone of emotional stability in trading. Practicing deep breathing exercises and mindfulness can anchor traders in the present moment, promoting emotional regulation and sound decision-making under pressure.

Additionally, establishing a structured daily routine brings stability and predictability, helping traders maintain discipline and emotional equilibrium.

Overcoming Fear

Taming fear begins with setting realistic expectations and achievable goals. Recognizing that losses are an inherent part of trading can alleviate the grip of fear and curb impulsive reactions. A well-thought-out trading plan, complete with predefined entry and exit strategies, acts as a guiding light, enabling traders to adhere to their decisions in the face of market fluctuations.

Balancing Greed

Greed can often lead traders astray. Setting clear profit-taking goals and steadfastly adhering to them ensures that profits are secured before the market takes an unexpected turn. Implementing stop-loss orders, a fundamental risk management technique, automatically caps potential losses, guarding against the siren call of greed and preventing traders from holding onto losing positions for too long.

The Power of Discipline and Emotional Intelligence

Discipline is the bedrock of successful trading. It demands that traders adhere to their strategies and deftly manage their emotions. Cultivating emotional intelligence sharpens decision-making skills, yielding more consistent results and steering traders away from impulsive actions.

The Art of Algorithmic Trading: How AI is Revolutionizing Forex

Enter the realm of algorithmic trading, also known as algo trading. This cutting-edge approach harnesses computer algorithms to execute trades based on predefined criteria, intending to eradicate human emotion from the trading equation and boost efficiency.

Algorithmic trading has witnessed a meteoric rise, with high-frequency trading firms and institutional investors deploying sophisticated algorithms to gain an edge in financial markets. Machine learning and AI algorithms are capable of analyzing vast datasets, identifying patterns, predicting market movements, and executing trades with unrivaled precision. In the world of forex trading, AI's lightning-fast data processing offers a significant advantage. It excels at identifying opportunities and managing risk, potentially resulting in higher profits and minimized losses.

High-frequency trading propels traders into a world where decisions are made in fractions of a second. AI-driven quantitative strategies rely on intricate mathematical models and statistical analysis to enable rapid decision-making and execution.

The Future of Trading: Bridging Emotions and AI

The future of trading lies at the intersection of emotional intelligence and AI-driven strategies. By fusing the ability to manage emotions effectively with AI's analytical prowess, traders can chart a course toward more consistent and profitable outcomes.

Researchers are actively developing AI systems capable of recognizing and responding to trader emotions in real time. This groundbreaking technology could usher in a new trading era, where emotional states are factored into decision-making processes. Embracing a holistic approach to trading—one that encompasses both emotional and algorithmic aspects—bestows traders with a distinct competitive edge.

After all, emotions are an integral part of human nature, and harnessing them alongside AI can lead to more resilient trading. In today's ever-evolving financial markets, adaptability is vital. By embracing both emotional intelligence and AI-driven strategies, traders can navigate the shifting landscape with confidence, ensuring their continued success.

![What [the heck] is InsurTech? image](https://media.fintastico.com/images/network-782707_1280.2e16d0ba.fill-72x72.png)