- 12/03/2018

Credimi, the Italian invoice financing fintech startups, has just ended its first year with record results: 80 million euros in financing over 5,000 invoices.

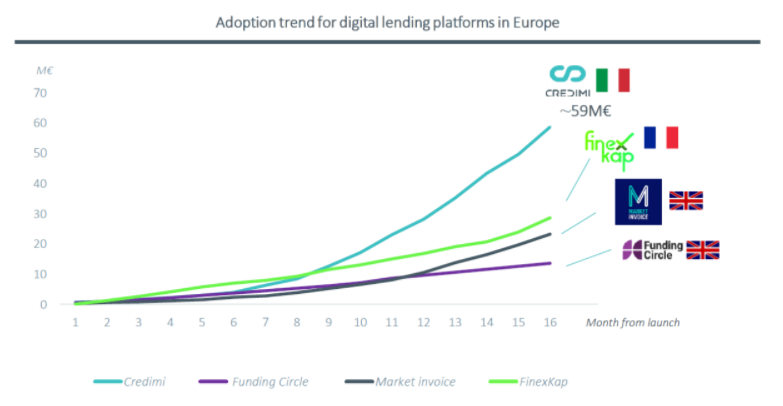

This performance made Credimi the fastest-growing digital financing platform for enterprises not just in Italy but in all of Europe, including the UK.

Source: Altfi - Credimi Data up to Dec 2017

Credimi continued to show impressive growth in January, with 10.8 million euroes in new loans and 28.1 million in the last 90 days.

"Credimi's results and the remarkable growth of invoice financing in Italy - even compared to countries taht are far more digitalized than Italy - shows that enterprises are paying more and more attention to innovative solutions and alternatives to traditional banking channels" said CEO and Founder Ignazio Rocco di Torrepadula. "In its first three years this market grew almost three times as quickly as the UK, which is by far Europe's largest market with 1 billion pounds lent in 2017. This shows that enterprises have a real need to diversify their funding sources. We are very pleased with our first-year results, but for us this is just a start. We are working each and every day and to improve our offer, we just updated our website to make it more user friendly."

Here are two reasons why Italy is a booming market for fintech companies:

- Italian entrepreneurs have to wait on average of 85 days to receive payments for an invoice. Only Greece (88) and China (89) have longer waiting periods. This delays means that Italian companies have an estimated 500 billion euros tied up in illiquid capital, weighing on balance sheets and putting a brake on innovation and growth.

- A "bank-centric" economy and the slow development of alternative finance channels has created pent-up demand. For example, the venture capital market in Italy has hovered for the past 15 years at 150-200 million euros annually, a fraction of the 5 billion euros for Europe, of which Great Britain raises 2 billion alone, France, and Germany between 400 million and 1 billion.

Sources: AIFI, Private Equity Monitor, Milan Polytechnic Observatory

![What [the heck] is InsurTech? image](https://media.fintastico.com/images/network-782707_1280.2e16d0ba.fill-72x72.png)