- 04/09/2017

Summary

- (Re)insurers-carriers are increasing their investments in Insurtech startups

- Partnerships between Incumbents and Insurtech startups are flourishing

- The report from Willis Towers Watson securities, Willis Re and CB Insights shows interesting statistics and graphs on the Insurtech sector

In this overview of the first half of 2017, we take a high-level look at progress to date (set in the context of the past five years) in number and value of deals, investors and startups, and the products in the global Insurtech market.

Our source is the Quarterly Insurtech Briefing (July 2017), a collaboration between Willis Towers Watson Securities, Willis Re and CB Insights, whose statistics and graphs appear here.

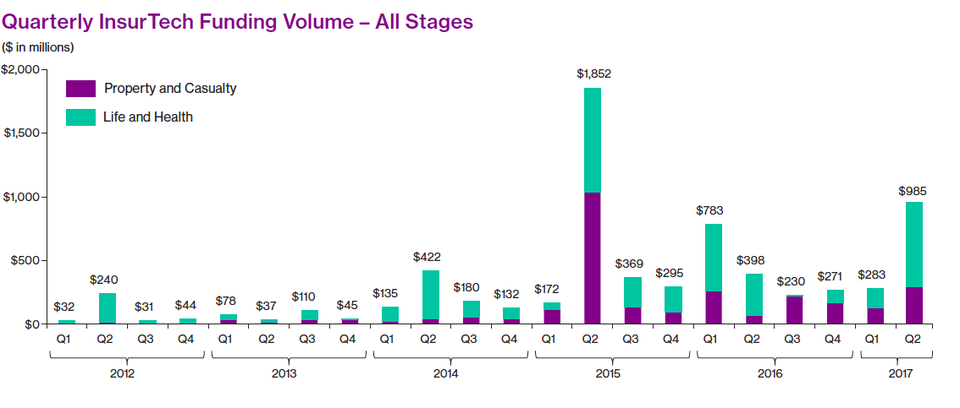

Deals (Volume and Value) Pick Up in Q2

Starting with Table 1 below we have been seeing roughly similar activity levels this year as in 2016: 93 deals worth US$ 1.18 billion in H1 2016 vs 102 worth US$ 1.16 billion in H2 2017. But if we take Q2 2017 by itself there is (potentially) significant change in the uptick to US$ 985 million - a 248% increase on Q1 2017's US$ 283 million and a 148% increase on Q1 2016.

Table 1

Source: Quarterly Insurtech Briefing Q2 2017

Most interestingly, the 64 transactions in this quarter are the highest seen to date - 68% increase from 38 transactions in Q1 2017 and 88% increase on the 34 in Q2 2016.

P&C funding value increased 127% on Q1 2017 and 71% on Q2 2016. The 34 P&C transactions in Q2 2017 represents a 48% increase from 23 in Q1 2017 and 89% increase from 18 in Q2 2016.

Life and health (L&H) funding value in Q2 2017 were up 347% from Q1 2017 and 113% on Q2 2016. 30 L&H transactions in Q2 2017 is an 100% increase from 15% in Q1 2017 and 88% increase from 16 in Q2 2016.

The big question here (given the volatility of relatively small number) is wheter this uptick - following a rather quiet Q1 - presages a more consolidated upward movement in investment.

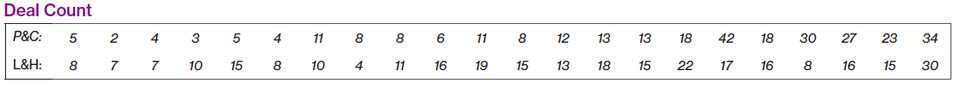

Early stage funding volume up

The only indication for an answer at this stage (Q2) is the 'bulge' in the funding tunnel (Table 2). In this case we have a strong increase in the Early Stage (Seed/Series A) which hit a record of 64 transactions with a value of US$ 289 million in Q2 2017. That was 62% of the total transactions' value in Q2.

Table 2

Source: Quarterly Insurtech Briefing Q2 2017

Assuming the normal trends in progression from Seed/Angel & Series A to Series B and later funding stages continues to apply (as per the aggregate picture 2012 to Q2 2017) then it is reasonable to assume increased investment in absolute terms in future.

Who or what is driving the uptick?

If this uptick is a new sustainable trend the next question is what is driving it.

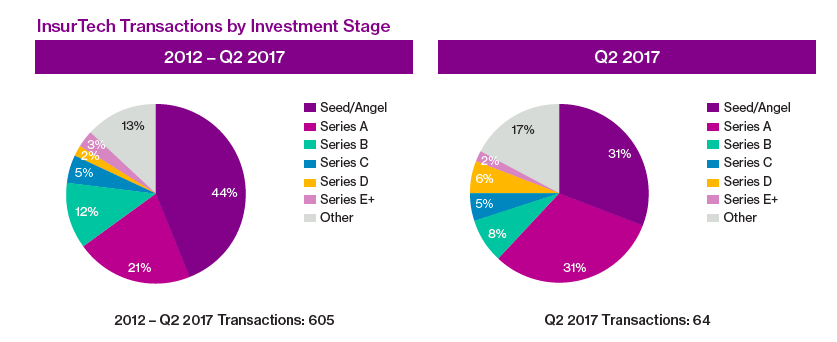

Distributor investments hold steady

As a percentage of the total investment brokers, MGAs and those focusing on lead generation remain active investors in platform development. Their concentration is holding up and growing slightly at 64% and 42% of Q2 2017 P&C and L&H transactions compared to 61% and 41% respectively over the period 2012 to Q2 2017.

VC investments share declining (relatively)

In the P&C market VC investment proportion has declined from 34% (2012 - Q2 2017) to 27% (Q2 2017). The drop is much greater in the L&H market - from 50% to 35%.

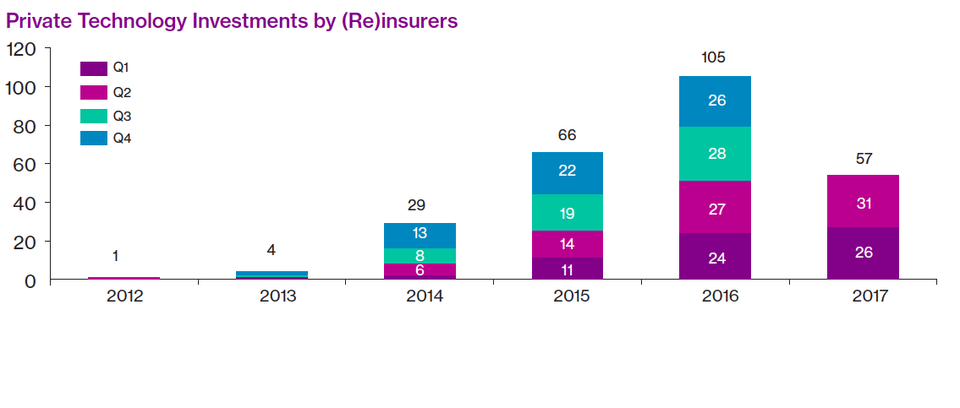

Carrier/incumbent investment growing

The real shift is towards the growing proportion of investment by (re)insurer-carrier investment: in P&C from 5% for 2012 - Q2 2017 to 9% in Q2 2017 and in L&H a truly dramatic increase from 9% in 2012 - Q2 2017 to 23% for Q2 2017.

Table 3

Source: Quarterly Insurtech Briefing Q2 2017

Some of the key carriers (of the many) driving the growth in the L&H sector by size of deal:

- Gryphon Insurance - $230 million Series A round - June 2017

- Bright Health - $160 million Series B round - June 2017

- Clover Health - $130 million Series D round - May 2017

Table 4

Source: Quarterly Insurtech Briefing Q2 2017

Key transactions including many major 'household-name' incumbents:

- Northwestern Mutual and Helvetia each launched corporate investment funds

- Validus announced invested $25 million in Aquiline's specialist Insurtech fund

- Baloise announced partnership with investment & advisory firm Anthemis to invest CHF 50 million in European, UK and U.S. based startups to drive forward Baloise's digital revolution

- Dispatch Technologies with Assurant Growth Investing and Liberty Mutual Strategic Ventures

As partnership flourish

A number of startups - the oft feared disruptors - have also started to form strategic investment partnerships with multiple (re)insurers incumbents such as:

- American Family with TrueMotion to produce a new app-based driver safety program

- CSAA partnered with Lyft to offer policyholders Lyft credits as an alternative to rental replacement

- Markel provides capacity for a personal trainers product underwritten by Next Insurance

- Generali with Google Nest to provide home thermostats to Generaly policyholders

- Aviva in a life insurance joint venture with Tencent and Hillhouse Capital in Hong Kong

- Lemonade with Allianz Ventures and XL Innovate

- Next Insurance with Markel Ventures, Munich Re / HSB Ventures and Nationwide Ventures

- Trov with Munich Re / HSB, Sompo Japan and Suncorp Group

Geographic Distribution

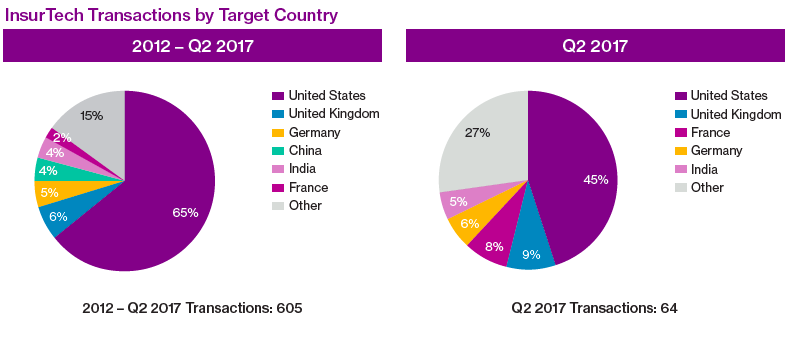

Insurtech is global but there are still striking regional differences in activity.

As can be seen in the Table 5 below, unsurprisingly, it's the US (65% in 2012 - Q2 2017 and 45% in Q2 2017) that still leads followed by other major industrialised nations. However, the US's much reduced share in Q2 2017 indicates in the continuing internationalisation of Insurtech as other countries start to catch up - a rebalancing trend which will undoubtedly continue.

Table 5

Source: Quarterly Insurtech Briefing Q2 2017

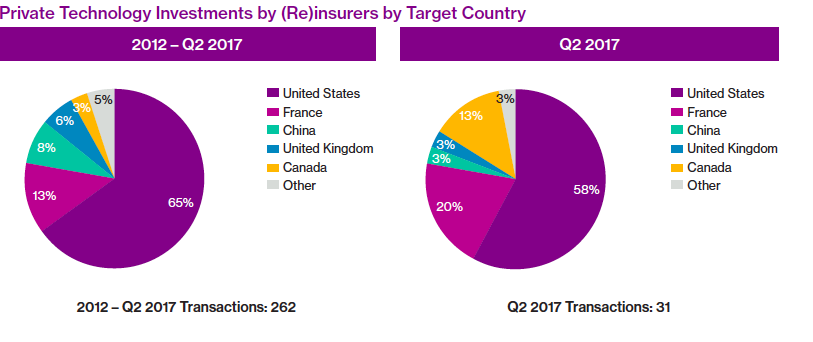

Interesting to note (Table 6) also with regard to the (re)insurer global investment profile that France (up from 13% to 20%) and Canada (up from 3% to 13%) have greatly strengtheed their position at the (relative) expense of the UK and China, and to a lesser extent the US.

Table 6

Source: Quarterly Insurtech Briefing Q2 2017

Hotspots - where are they investing?

Several clusters continue to consolidate, each with their own sub-classes representing the inevitable trend for innovators to slice the insurance value-chain down to micro-level and provide transformational improvement across its entirety as this level.

Many of the products are heterogeneous and can only be grouped into loosely related clusters (today, but that's inevitably going to change as the market consolidates), covering varying parts of the value-chain from full life-cycle down to very specific functions:

- API wholesale

- Claims management, loss adjusting and surveying

- Comparison and aggregation sistes

- Cyber risk insurance

- Data & analytics

- Healthcare & life insurance market platforms

- IoT integration

- Pensions

- Risk management

- Small business insurance

- Underwriting and policy management

On the list above two areas currently stand our in terms of consistent development trends to follow:

Small Business Insurance

Several startups focussing on this received new investments and/or established new partnerships during the quarter:

- Bunker - $6 million Series A round in May 2017

- Embroker - partnership with Zenefits in June 2017 to transfer Zenefits P&C program customers to Embroker

- Next Insurance - $35 million Series A round (April 2017) and is currently discussing partnership opportunities with American Express (American Express Ventures invested in Next in June 2017)

Claims Management

Claims handling, always the poor relation of flamboyant underwriting, is, as ever, key. There have been many good systems built for this insurance discipline but clearly, given the great variety and technical complexity of claims, particularly in liability, there's a need for much more sophisticated technology to support this.

And so we find that (re)insurers are targeting strategic investments in, and partnerships with, technology startups with claims management applications.

Again, some examples quoted in the report:

- Snapsheet - $12 million Series D round in June 2017

- ControlExpert received an undisclosed investment from General Atlantic in May 2017

Conclusions - for now and with a few caveats

Caveats are in order: it's not just difficult to pin down a definition of Insurtech, it's also challenging trying to make sense when looking at the statistics and analytics on such small numbers.

The reason is very simple: it's very early days. What we see today is embryonic and therefore minute in comparison to what will be the situation, say, in 2020 or 2030 and onwards. As everyone knows, the modern insurance industry runs in multi-decadal cycles.

So analysis of quarterly, or even annual figures and trying to discern trends needs to be done with caution.

But nevertheless - bearing that health-warning in mind - it's essential to keep a close eye on the market's movements - helped by the improving analysis of this sector. That goes not just for the all those directly involved such as innovators and investors but for a wider readership. Insurance, after all, is one of the big financial services underpinning the global economy and touching everyone's lives.

Conclusions so far?

Not many for one quarter in one year, save only to say that Insurtech is going to grow and develop exponentially, and transform much of what we do today in corporate and personal finance.

![What [the heck] is InsurTech? image](https://media.fintastico.com/images/network-782707_1280.2e16d0ba.fill-72x72.png)