- 13/03/2018

In the last years, the financial industry is looking for new and more profitable approaches for extracting value from the markets. This task is becoming harder day after day and for this reason the entire investment world is looking with hope to artificial intelligence.

Generally, "old school" fund managers are skeptic and reluctant in accepting suggestions made by a machine on what to buy or sell. However, in the last quarter 2017 two AI-driven ETF (Exchange Traded Funds) were born, showing that sophisticated solutions are not anymore an exclusive for hedge funds but they can also be bought by retail investors.

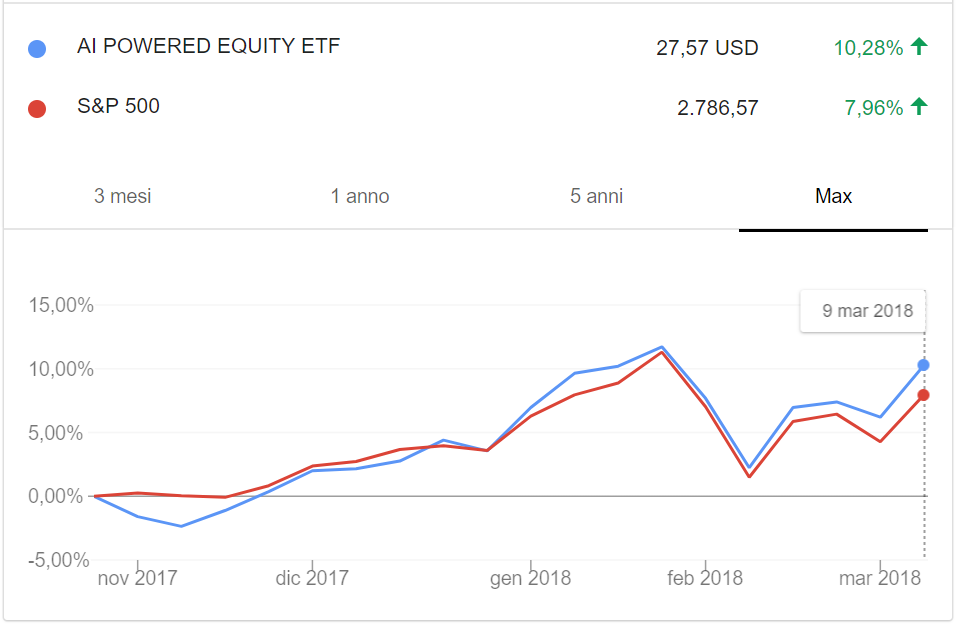

The first ETF has been launched on the 18th of October 2017 and it's called "AI Powered Equity ETF" (ticker:AIEQ). Its performance till the 9th Marc 2018 was +10.3%, overperforming the S&P 500 index by almost 2.3%. AIEQ's investments are concentrated on the American stocks and its management fees are 0.75%, a cost justified by the 2-3% daily turnover of the fund. (Source: equbotetf.com)

Source: Google Finance

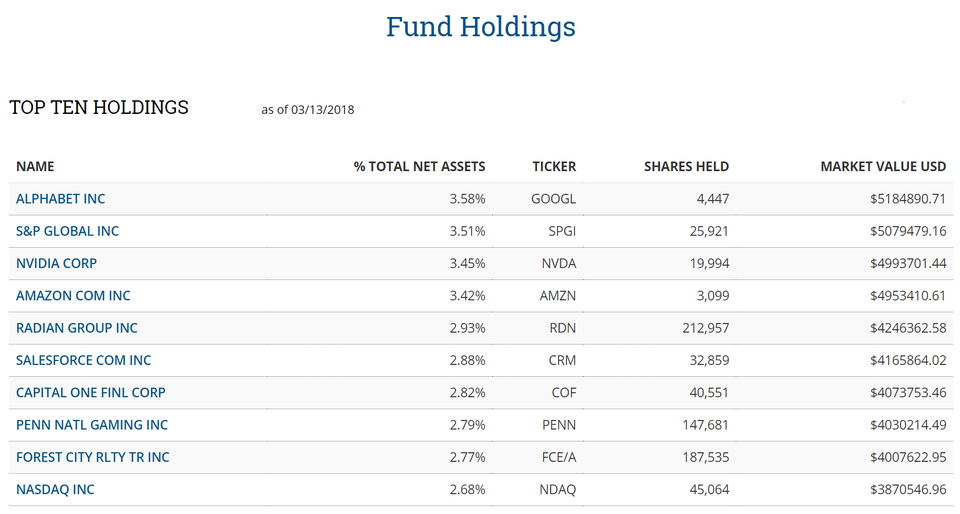

The AIEQ fund is actively managed, and its decisions are base on a quantitative model, called EquBot, based on IBM's Watson platform. The proprietary algorithm takes decisions based technical and fundamental analysis, correlations among assets, news and social networks sentiment. The aim of the model is to build a portfolio ranging between 30 and 70 holdings corresponding to the stocks that look more promising. As of 13rd March 2018, the portfolio is diversified among 75 stocks and the top 3 holdings are Alphabet (3.58% of total net assets), S&P Global Inc. (3.51% of total net assets), and Nvidia (3.45% of total net assets).

Source: equbotetf.com

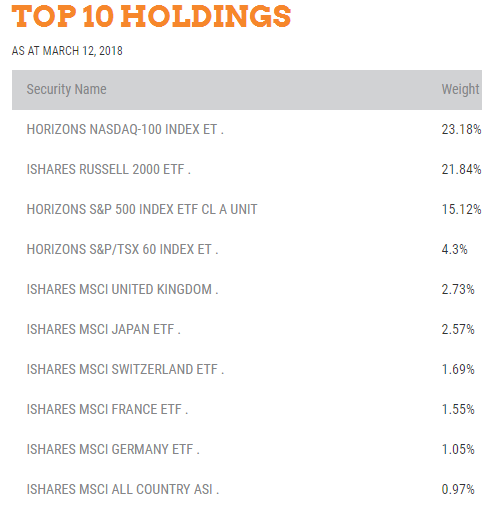

The second AI-driven ETF is called "Horizons Active A.I. Global Equity ETF" (ticker: MIND) and it has been launched on the Canadian market on the 1st November 2017. Its investments are diversified among a basket of global indexes ETFs and its decisions are based mainly on the recognition of technical analysis patterns (e.g. moving averages crossing, Relative Strength Index, etc.). As of 9th March 2018, 60.3% of the portfolio, corresponding to the top 3 positions, is concentrated in American indexes. (Source: horizonsetfs.com/etf/mind).

Source: horizonsetfs.com/etf/mind

In contrast to what shown by its American "cousin", MIND lagged the S&P 500 by almost 3% (including a slightly negative forex effect) since its start.

Source: Google Finance

MIND's portfolio can be composed by a minimum of 2 and a maximum of 20 ETFs and its management fees are 0.5%. This cost is lower that AIEQ's because the portfolio is rebalanced on a monthly basis.

In this case, the AI engine has been developed by Qraft Technologies and it is based on neural networks trained for recognize patterns and take high-speed independent investment decisions. This process allows to overcome any human cognitive bias.

Final Thoughts

Every day important trading decision are taken by smart and autonomous artificial intelligence algorithms. At the beginning, only hedge funds were interested in these solutions but today the audience includes also institutional investors.

Among the most promising approaches we can find unstructured natural language analysis of news, company reports, and social media posts, in an effort to catch insights associated to the future performance of companies, currencies and commodities.

However, we can't predict if the proliferation of AI-driven investments will change financial markets dynamics as we know them.

![What [the heck] is InsurTech? image](https://media.fintastico.com/images/network-782707_1280.2e16d0ba.fill-72x72.png)