- 22/11/2020

"The biggest idea in banking right now is blockchain technology. "

Bradley Leimer, Head of Innovation at Santander Bank

"While blockchain technology is relatively new, it is also a continuation of a very human story, and the story is this. As humans, we find ways to lower uncertainty about one another so that we can exchange value."

Bettina Warburg, blockchain researcher, entrepreneur and educator

Contracts, transactions, and the records of them play a central role in our economic, legal, and political systems. They protect assets and set organizational boundaries. They establish and verify identities. They govern interactions among nations, organizations, firms, communities, and individuals. They guide managerial and social action. And yet these critical tools and the bureaucracies behind them have not kept up with the economy's digital transformation.

Blockchain promises to solve this problem. Blockchain technology could represent the most radical (r)evolution from longstanding financial bookkeeping practices since Luca Pacioli formally codified the Italian double-entry accounting system in the 15th century.

This system is also known as the Method of the Merchants of Venice. It is the first system that allowed merchants to measure the worth of their business. Luca Pacioli - monk, mathematician, alchemist, and friend of Leonardo da Vinci - adapted Arabic mathematics to provide a system that could work across all trades and nations. Double-entry accounting was revolutionary: it enabled capitalism to flourish and created the global economy.

The technology at the heart of bitcoin and other cryptocurrencies, blockchain is an open, distributed ledger that can record transactions between two parties efficiently and in an accountable and permanent way. With blockchain, we can imagine a world in which contracts are embedded in digital code and stored in transparent, shared databases, where they are protected from deletion and tampering. In this scenario, every agreement, every process, every task, and every payment would have a digital record and signature that could be identified, validated, stored, and shared.

Distributed Ledger Technology (DLT) has several attractive characteristics:

- Transactions can be made to irrevocable, and clearing and settlement can be programmed. In this way distributed ledger operators could improve the accuracy of trade data and reduce settlement risk;

- Systems operate on a peer-to-peer basis and transactions are near-certain to be correctly executed;

- Each transaction in the ledger is openly verified by a community of networked users rather than by a central authority;

- A publicly accessible historical record of all transactions is created: this could bring about adequate monitoring and auditing by participants, supervisors and regulators.

Blockchain is celebrated as "the new Internet of Finance" and is poised to transform multiple sectors, especially the financial services. The World Economic Forum estimated that more than 1.4 billion USD have been invested in this technology.

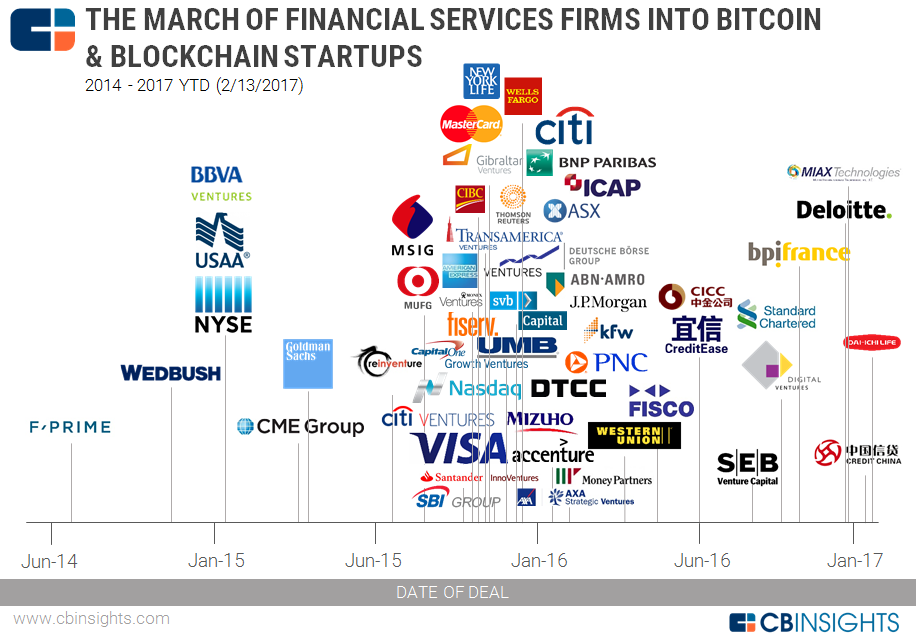

Many large corporations in banking and finance - according to Accenture, nine in 10 banks are currently exploring the use of blockchain in payments - now have a specialist blockchain development team, something that barely existed even a year ago. As the chart below from CBInsights shows, strategic investments into bitcoin or blockchain startups over the past three years hit its apex in the fall of 2015 and into the winter of 2016.

Since 2015, several financial institutions have begun to implement plans for the blockchain sector. Goldman Sachs, J.P. Morgan, UBS, and other banking giants have all established their own blockchain laboratories, working in close collaboration with blockchain platforms, and published a series of studies on this topic. Goldman Sachs even filed a patent for transaction settlement based on blockchain technology. Additionally, various national stock exchange, such as the Nasdaq Stock Market and the New York Stock Exchange have also conducted in-depth research on blockchain technology.

Different types of blockchain industrial consortiums have emerged in order to promote the development of blockchain technology and its applications, the R3 blockchain consortium being the most influential among them. It has brought together over 40 of the world's leading financial institution, including Bank of America, Citigroup, Morgan Stanley, Deustche Bank, and Barclays Bank. As of May 2016, Ping An Bank and China Merchants Bank (CMB) have also joined the R3 blockchain constortium, thus strengthening the exchange and cooperation of top financial institutions in the blockchain technology.

There has also been widespread optimism regarding the application of blockchain in the banking industry. In May 2016, McKinsey conducted a survey on global banking executives, finding that approximately half of executives believe that blockchain will have a substantial impact within 3 years, with some even considering that this will happen within 18 months. Another survey of 200 global banks predicted that, by the following year, blockchain technology will be extensively implemented by 15% of 61 banks. Furthermore, IBM has stated that, in 4 years, 66% of banks will have commercial blockchain at scale.

As such, an increasing number of banks have begun to be pay greater attention and place emphasis on blockchain.

Also regulators and governments have begun to take the technology seriously. For example, the European Commission (EC) is establishing European Union Blockchain Observatory in response to a European Parliament mandate to strengthen technical expertise and regulatory capacity. The project, announced on the EC website, will include an observatory and a forum to gather input on distributed ledger technology and blockchain technology. The goal is to establish an EU expertise resource fo forward-looking blockchain topics and develop EU use cases.

Similarly, the European Central Bank (ECB) has declared itself interested in Distributed Ledger Technology (DLT) "to be as efficient as possible". The ECB considers new technologies as essential to enhancing the efficiency of our market infrastructure. However, it's time to frame the discussion.

![What [the heck] is InsurTech? image](https://media.fintastico.com/images/network-782707_1280.2e16d0ba.fill-72x72.png)